Reduce Taxes and Support Our Work

Did you know that retirement accounts are exposed to federal income taxes that could be as much as 37% upon your death? The good news is that these taxes can be eliminated or reduced through a carefully planned charitable gift.

Consider leaving your loved ones less heavily-taxed assets and leaving your retirement plan assets to the Winston-Salem Rescue Mission to support our work. As a nonprofit organization, we are tax-exempt and will receive the full amount of what you designate to us from your plan. You can take advantage of this gift opportunity in several ways, illustrated on the following pages.

Ways to Donate Your Retirement Account

List the Rescue Mission as a beneficiary of your account.

The simplest way to leave the balance of a retirement account to WSRM after your lifetime is to list the Winston-Salem Rescue Mission as the beneficiary on the form provided by your plan administrator. If you are married, your spouse must sign a written waiver.

Give from your IRA.

If you are 70½ or older, you can give any amount up to $105,000 from your IRA directly to a qualified charity such as WSRM without having to pay income taxes on the money. Beginning in the year you turn 73, you can use your gift to satisfy all or part of your required minimum distribution.

Make WSRM a contingent beneficiary.

If you prefer to make your spouse the primary beneficiary of your retirement account, you can name the Rescue Mission as the contingent beneficiary. Want your children to benefit, too? Designate a percentage for WSRM with the remainder for your children.

Give from your IRA and receive income in return.

If you are 70½ or older, you can make a one-time election of up to $53,000 (without being taxed on the distribution) from your IRA to fund a charitable gift annuity—the gift that pays you. Special rules apply, so contact us for more details and a personalized illustration at no obligation.

Example: Tax-Smart Planning

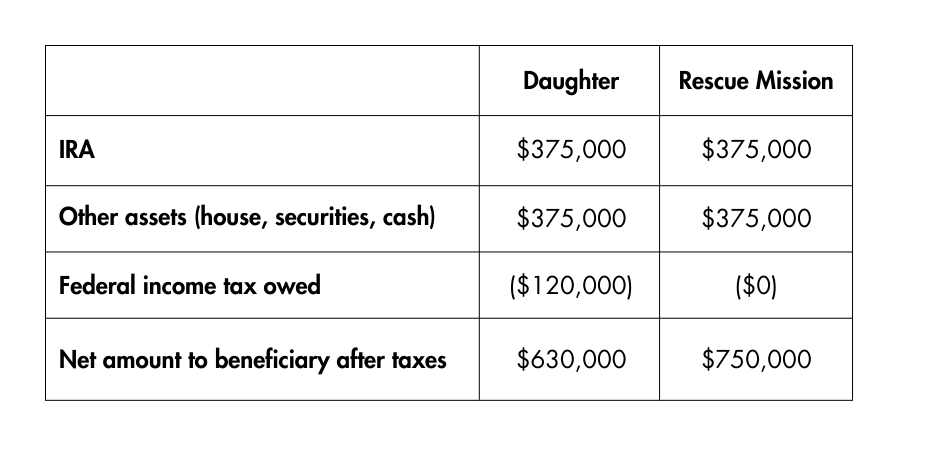

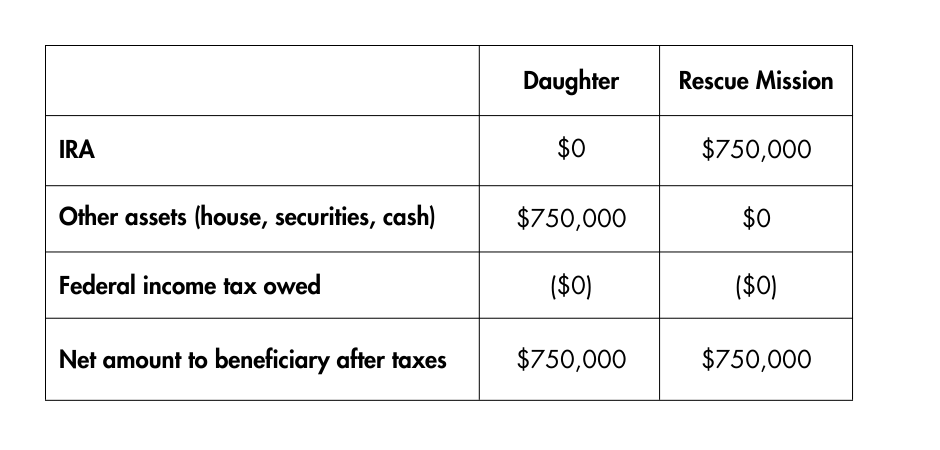

A longtime donor with a $1.5 million estate wants to leave the Rescue Mission a gift valued at $750,000. They also want to leave something to their only daughter who is in the 32% federal income tax bracket. Take a look at the options.

Option 1: Our donor divides assets equally between the daughter and the Winston-Salem Rescue Mission.

Option 2: Our donor names the Rescue Mission the beneficiary of retirement plan assets and leaves the daughter all other assets.

Next Steps

For more information, we would be happy to answer any questions regarding charitable giving that you may have. Feel free to contact us at no obligation.

-

Brian Weer, Director of Development

-

Phone: 336.842.5308

-

development@nullwsRescue.org

-

PO Box 595, Winston-Salem, NC 27101

-

Meet the team

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.